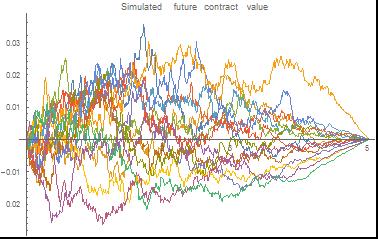

Knowing derivatives exposure is essential part of prudent risk management and counterparty risk in particular. Therefore institutions that trade financial derivatives and derivative dealers alike need to have sophisticated systems to calculate exposures for their contacts and portfolios. Mathematica 10 comes as a powerful alternative to traditional risk engines and provides quick, easy and flexible handling of exposure management. The Part I demonstrates the use of numerical routines and shows the Monte Carlo integration of the exposure calculation process.

Attachments:

Attachments: