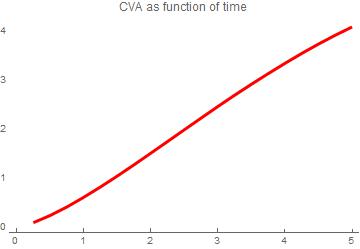

Credit Valuation Adjustment also known as CVA - is closely followed regulatory measure that provides the method for the OTC derivative contract valuation correction due to a counterparty default. In this way, CVA can be seen as a provision to be held against a derivative transaction in the event of default. Computationally, CVA is a logical extension of the exposure method presented in the previous documents. Here we present a Monte Carlo numerical CVA approach with a dependent swap rate - hazard rate process and demonstrate why Mathematica 10 is ideally suited for this task.

Attachments:

Attachments: