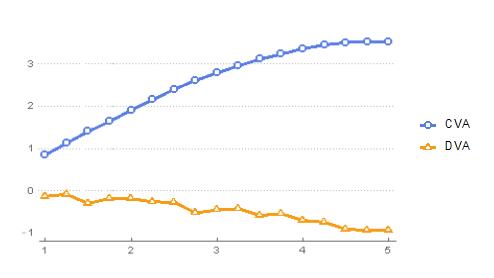

Bilateral CVA extends the credit valuation adjustment concept in the opposite direction where financial standing of the financial institution comes into play. The logic of the BCVA is based on symmetrical correction of derivatives exposure where creditworthiness of both sides matters. Computationally, BCVA is much more involved since there are now three levels of uncertainty (derivative exposure and credit standing of both counterparties) which can even be dependent. However, Mathematica 10 simplifies implementation in a number of ways and provides excellent platform for this task.

Attachments:

Attachments: