We depend on financial services that sometimes are off on their side to provide the data. What I would recommend is to use Wolfram|Alpha calls. For example in your case:

tmp = WolframAlpha["EUR vs USD from 2005 to 2008", {{"Result", 1}, "ComputableData"}];

DateListPlot[Most[tmp], PlotTheme -> "Detailed", AspectRatio -> 1/3, Filling -> Bottom]

Below is explanation to understand this code.

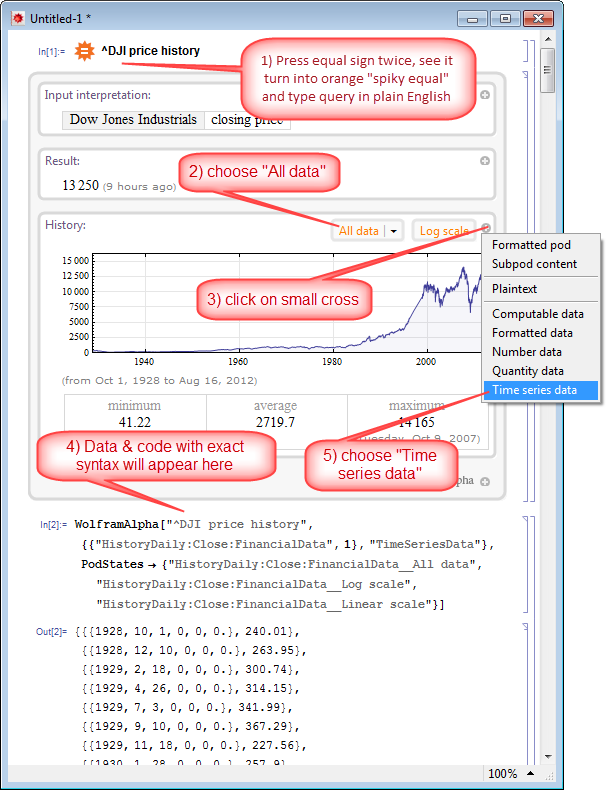

If one looks for curated data accessible from Mathematica, the WolframAlpha function should always be considered as an option, because it links to curated data bases with frequent continuous updating:

data = WolframAlpha["^DJI price history",

{{"HistoryDaily:Close:FinancialData", 1}, "TimeSeriesData"},

PodStates -> {"HistoryDaily:Close:FinancialData__All data"}];

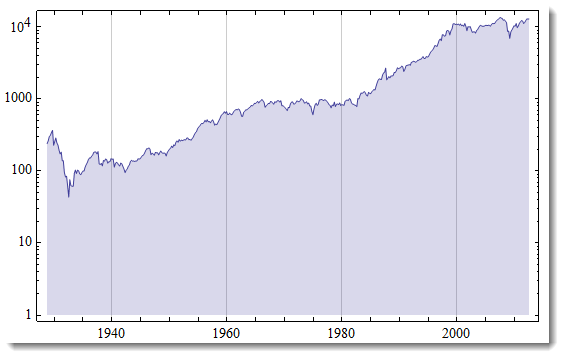

And this is basically the same plot as in the documentation:

DateListLogPlot[data, Filling -> 1, Joined -> True]

You also can access these data interactively to get the same programming syntax. This can actually teach how syntax looks in different cases:

To understand better WolframAlpha integration in Mathematica I suggest the following sources: