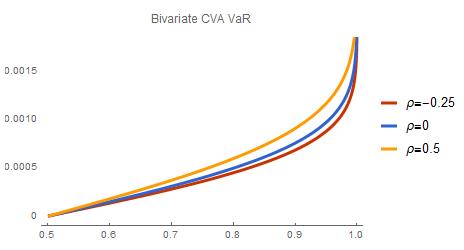

CVA Value-at-Risk plays important part in the counterparty credit risk management and is essential ingredient of the CVA capital charge under Basel III. Despite wide coverage in the press, the concept of CVA VaR s still not well understood and there is a gap in comprehension of the Basels standardized CVA VaR formula. We provide an explanation of the Basel III logic and show extensions that lead to much more elegant formulas both in normal and non-normal setting. Bivariate enhancement is also presented in this context.

Attachments:

Attachments: