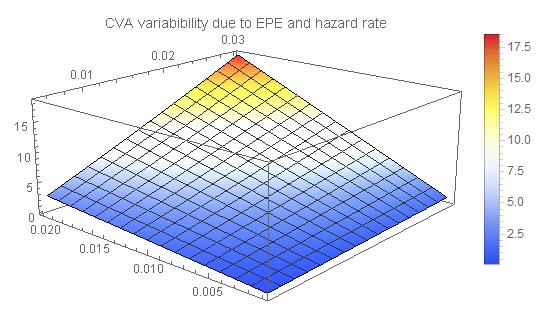

CVA sensitivities represent practical method for quick and accurate assessment of the measure when the input starts changing. In this way the use of functional derivatives is useful since they provide critical answers to what-if scenarios when the CVA risk analysed. Equally important is the ability to rank derivatives by their impact and see how risky is each factor variation is relative to other model parameters. Using the interest rate swap as an example, we look at EE and CVA derivatives in detail and examine what one may expect in dynamic market environment. We extend the analysis to include total derivatives of CVA and show how they differ relative to standard partial derivatives.

Attachments:

Attachments: