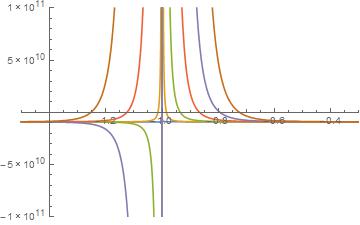

You should always plot a graph when doing any solving type activity. Some of your equations have two solutions as I alluded to before. When you use find root you will get one of them and this may not be the same one excel gets. Use solve to get both. Sometimes you can also get multiple solutions if you have alternating cash flows and most introductory finance texts note this as one of the drawbacks of internal rate of return.

Solve[TimeValue[Cashflow[values[[1 ;; 7]]], r, 0] == 0, Reals]

{{r -> -1.25357}, {r -> -0.724255}}

Check both of your answers.

TimeValue[Cashflow[values[[1 ;; 6 + 1]]], r, 0] /. {r -> -1.2535683433939733`}

TimeValue[Cashflow[values[[1 ;; 6 + 1]]], r, 0] /. {r -> -0.7242552925326607`}

Plot the NPV. There are two solutions for some of the NPV curves.

NPV[i1_] := TimeValue[Cashflow[values[[1 ;; i1 + 1]]], r, 0];

curves = Map[NPV[#] &, Range[1, 6]];

Plot[curves, {r, -1.5, 0.3},

PlotRange -> {{-1.5, -0.3}, {-100000000000, 100000000000}}]