Hi Rachel,

What is the definition of RateOfChange? It is not a built-in WL function. It is a FinancialIndicator, and those can be applied to a TimeSeries. E.g.

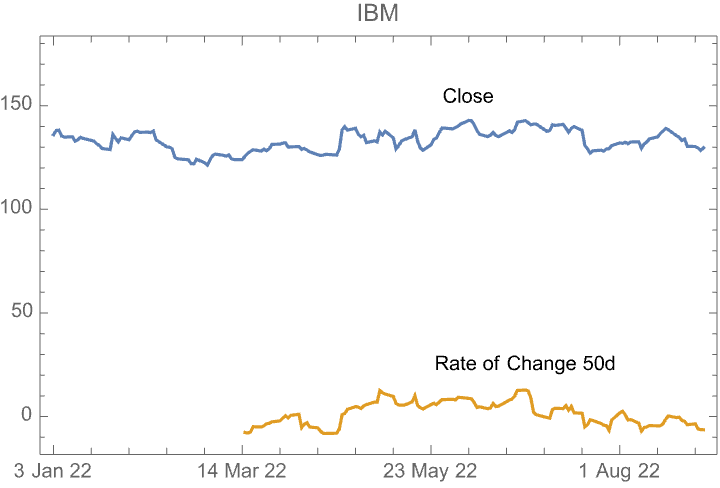

data = FinancialData["IBM", "Close", {{2022, 1, 1}, {2022, 9, 1}}]

rateOfChange50 = FinancialIndicator["RateOfChange", 50]@data

You can apply any FinancialIndicator to a TimeSeries as long as it has the required data. E.g. to apply "PriceVolumeTrend" the TimeSeries must have the values for Close and Volume.

To get the values from these TimeSeries

data // Normal

rateOfChange50 // Normal

To plot them

DateListPlot[{data, rateOfChange50},

PlotLabel -> "IBM",

DateTicksFormat -> {"DayShort", " ", "MonthNameShort", " ", "YearShort"},

PlotLabels -> Placed[{"Close", "Rate of Change 50d"}, Above]]

There is no easy way to extract these values from TradingChart