I did something similar. I am trying to work on a trading system to estimate where the next set of returns should fall on the indexes and sectors to fill in the gaps, in order to complete a model symmetric returns distribution and volatility clustering profile. I am still working through it, but I think that including some short term VIX trends may help in locating which side of 0 the immediate returns (1-3 days out) will have a higher probability of landing on.

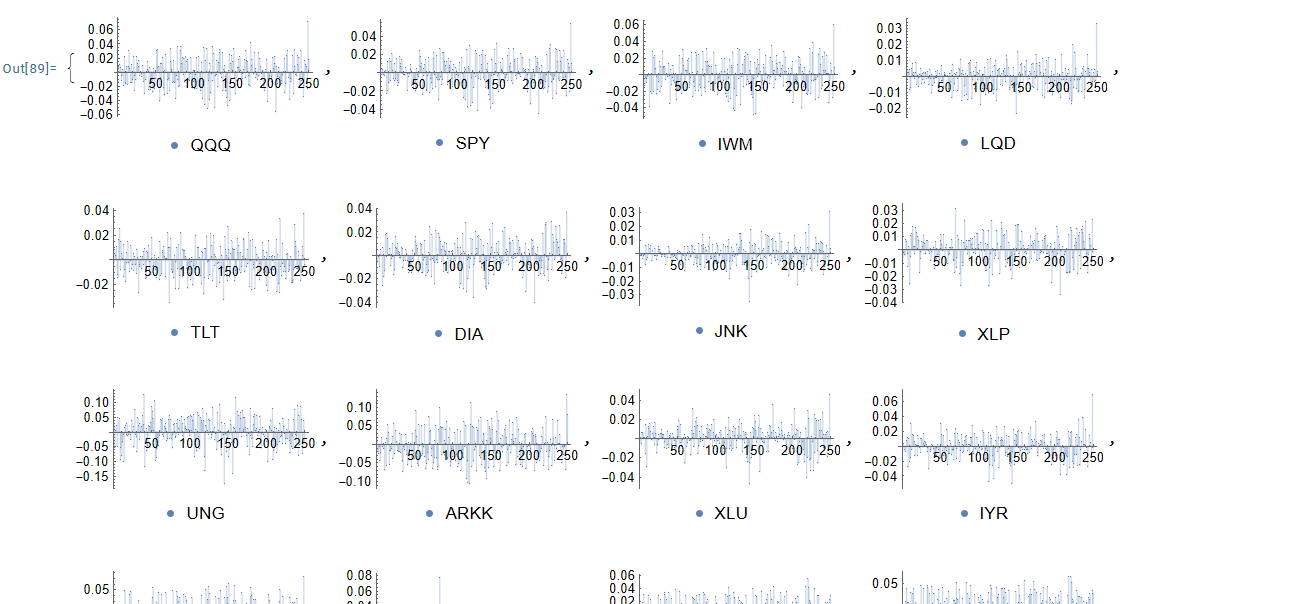

Catalog

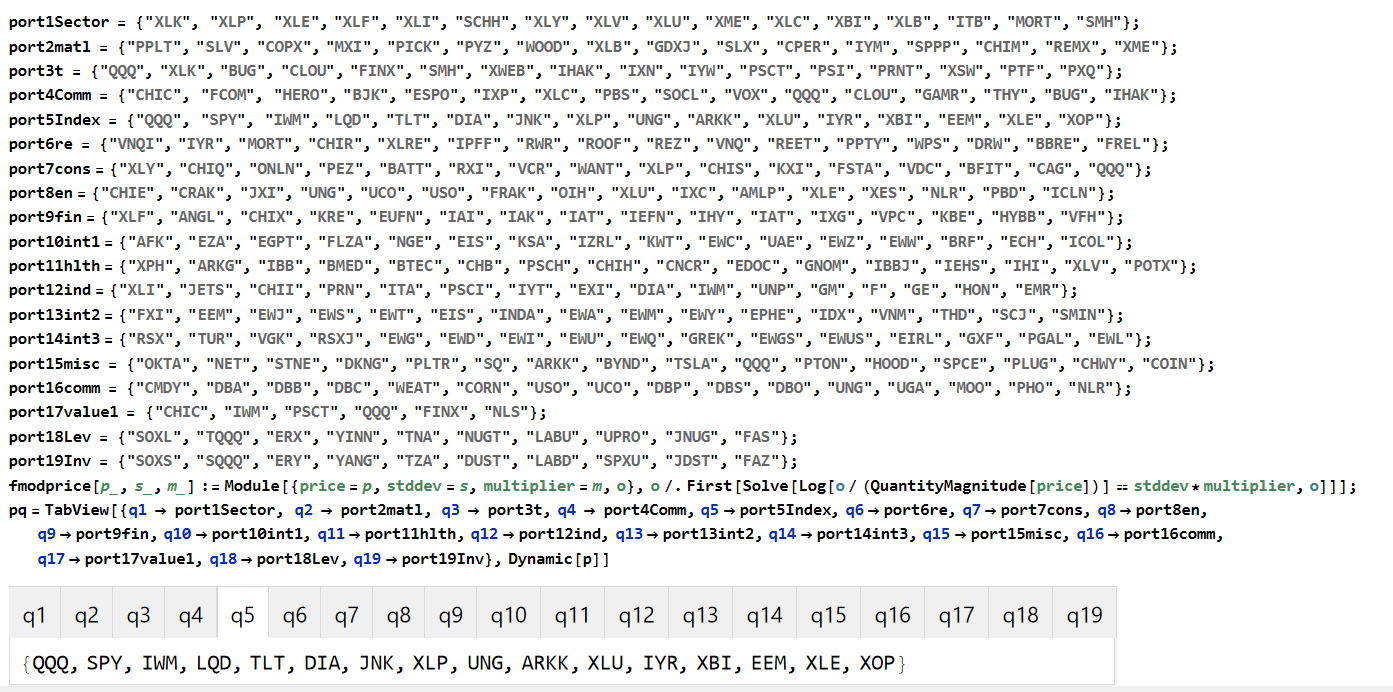

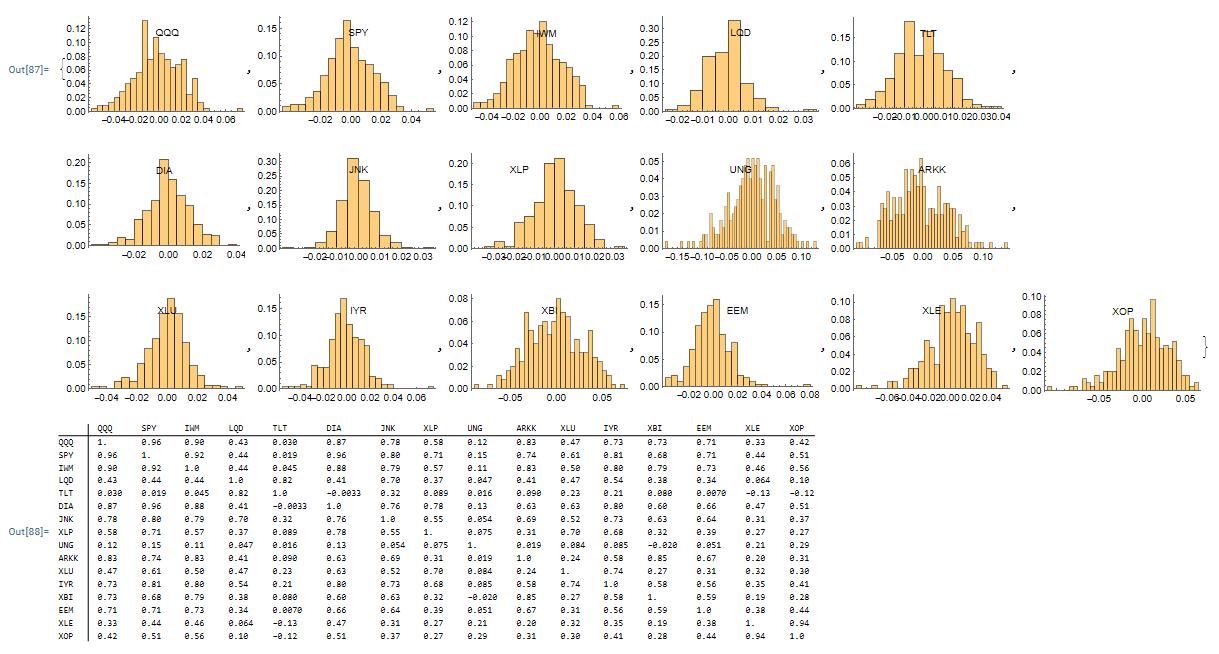

Returns Distribution Analysis:

Correlation Matrix

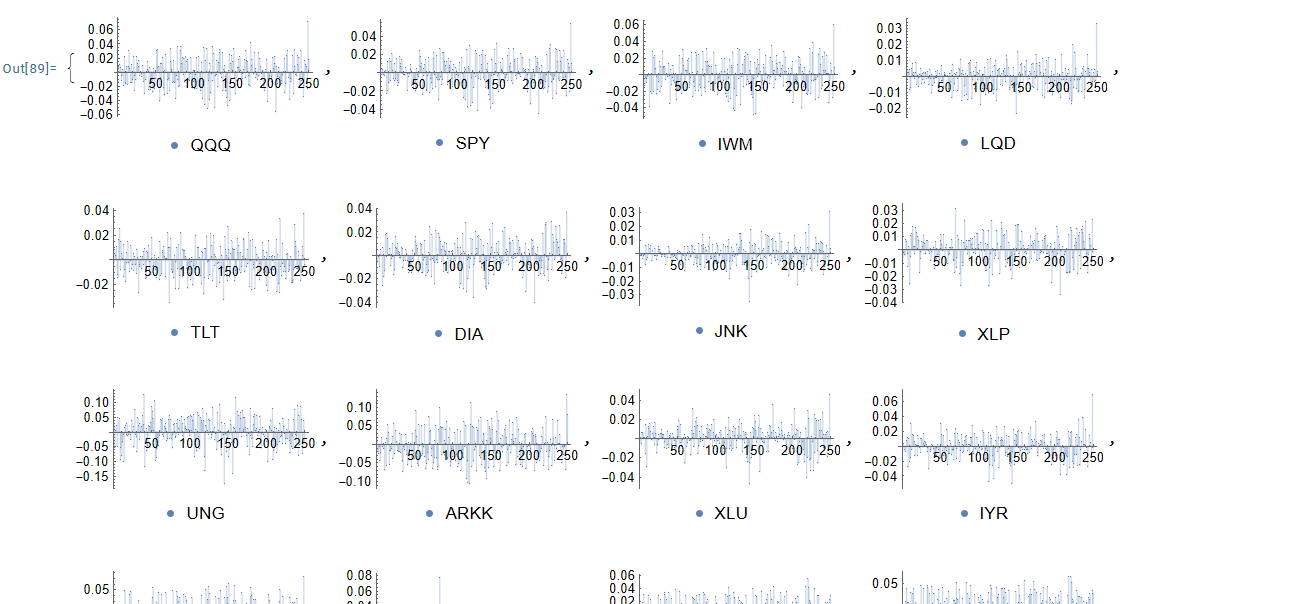

Volatility Plots: