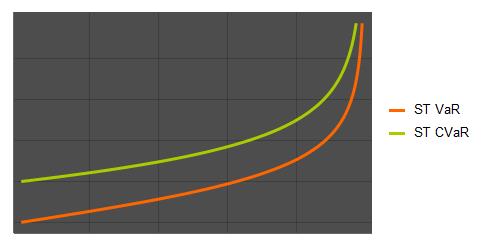

Value at risk is a standard risk measure applied to a large variety of financial instruments. Despite its popularity, VaR is being gradually replaced by its more advanced alternative the so-called Conditional VaR (known also as Tail VaR or Expected Shortfall) which resolves the limitations of VaR, primarily in the extreme tail of the distribution. We examine nice analytical properties of both risk metrics for various symbolic risk distributions and demonstrate the use of VaR / CvaR in time series process.

Attachments:

Attachments: