Tuoyi,

If I understand what you are trying to do, I would use Differences to find the jump:

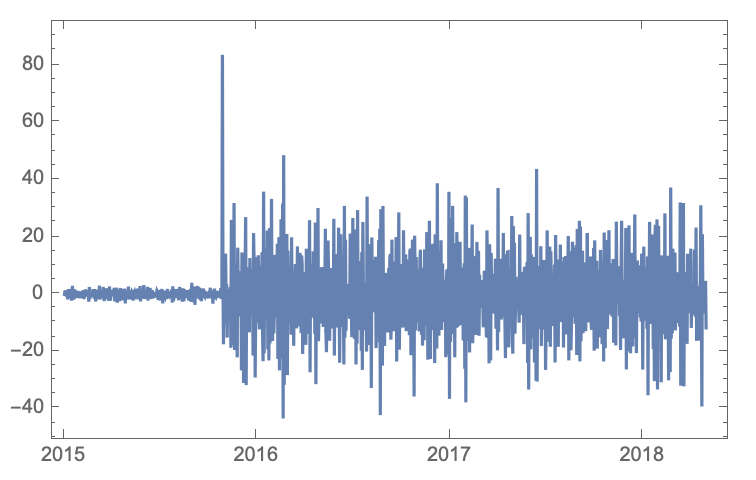

DateListPlot[Differences[ts], PlotRange -> All]

to get the break at the peak

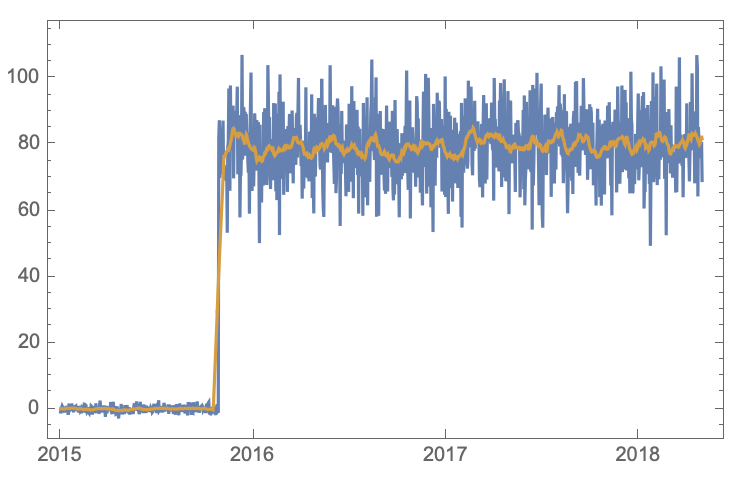

If the noise is a problem you can filter it: (in this case with a 10 day filter)

filt = MeanFilter[ts, 3600*24*10]

DateListPlot[{ts, filt}]

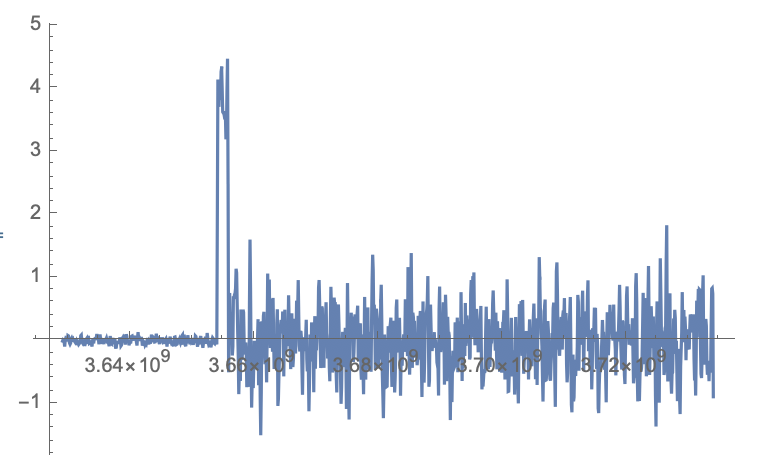

ListLinePlot[Differences[filt], PlotRange -> All]

ListLinePlot[Differences[filt], PlotRange -> All]

Now you have a more distinctive break (peak). There are many ways to find the peaks depending on exactly what you are trying to do. I hope this helps.

Regards,

Neil