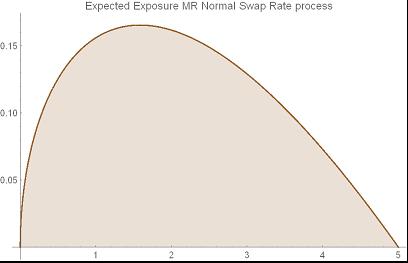

Analytical approach to derivatives exposure is less common in practice, however for vanilla contracts where the future rate process can be defined in terms of known functions, it can bring certain advantages. Clarity, intuition and tidiness are prime examples. Mathematica 10 is perfectly suited for this task since its symbolic engine is robustly designed and optimised to handle these tasks efficiently.

Attachments:

Attachments: