Hi,

the following lines of code might help.

names = RandomChoice[FinancialData["^DJI", "Members"], 10]

u = FinancialData[#, "Price", {{2000}, {2010}, "Day"}][[All, 2]] & /@ names;

The first one gets the names of 10 DowJones companies. The second one downloads share prices for them. The resulting variable u has the format you want.

u[[1,5]]

gives the value of share of the first company at time 5. It is easy to find out the shortest of the time series by:

mlength = Min[Table[Length[u[[k, All]]], {k, 1, 10}]]

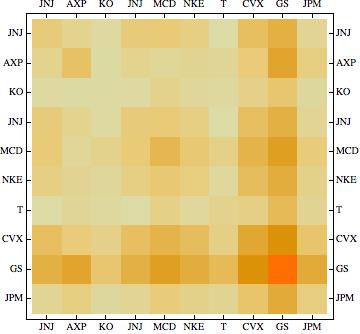

Now we might calculate the matrix of all covariances:

covtable =

Table[Covariance[u[[i, 1 ;; mlength]], u[[j, 1 ;; mlength]]], {i, 1, Length[names]}, {j, 1, Length[names]}];

A little plot helps to visualise the result

Show[MatrixPlot[covtable], FrameTicks -> {Table[ {i - 0.5, ToString[names[[i]]]}, {i, 1, Length[names]}], Table[ {i - 0.5, ToString[names[[-i]]]}, {i, 1, Length[names]}]}]

which gives

I hope that this helps.

Cheers,

M.