Thank you Nicholas,

I tried working with your code and got closer to my target. I managed a 50 day moving average, which was interesting on upst, and questionable, seems like there is a mistake here?? Unless one or two very large jumps are moving through the average causing the distortion??

data = FinancialData["UPST", "OHLC", {2021}];

diff50HL =

MovingAverage[

MovingMap[#Values[[-1, 2]] - #Values[[1, 3]] &, data,

Quantity[2, "Events"]], 50];

DateListLogPlot[diff50HL]

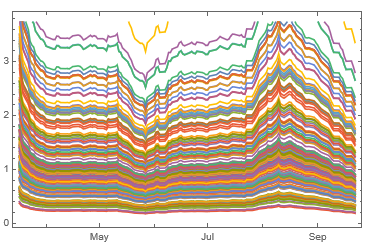

I got the differences between the high & low, the high & close, and the low & close --

diffHL = MovingMap[#Values[[-1, 2]] - #Values[[1, 3]] &, data,

Quantity[2, "Events"]];

diffHC = MovingMap[#Values[[-1, 2]] - #Values[[1, 4]] &, data,

Quantity[2, "Events"]];

diffLC = MovingMap[#Values[[-1, 3]] - #Values[[1, 4]] &, data,

Quantity[2, "Events"]];

Threaded the three differences together to determine the maximum difference --

diffT = Transpose[{Flatten@diffHL["Values"],

Flatten@Abs[diffHC["Values"]], Flatten@Abs[diffLC["Values"]]}] ;

diffMax = Max[#] & /@ diffT ;

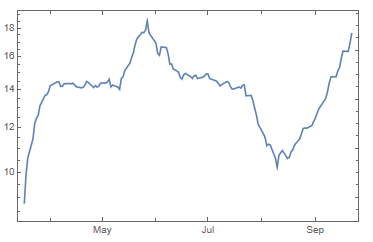

And then I got stuck, try as I am, hours later, I still was not able to compute a moving percentage of the maximum difference and 50 day moving average of the high-low (range). The only result I got was diffidently not what I wanted

mm = MovingAverage[diffMax/diff50HL, 1];

DateListPlot[mm]

Everything else I tried crashed and burned. Thank you for any help that you can provide.